Sustainability reporting practices to consider, no matter what the future holds

Sep 30, 2025

Sharing some thoughts and insights on sustainability reporting practices for companies to consider, especially those just getting started.

I recently had the pleasure of joining Tim Siegenbeek van Heukelom and Seth Forman of Socialsuite in a conversation on how companies can plan their sustainability strategy with confidence as we round the corner towards 2026. I’m very grateful for this opportunity to share my thoughts and insights on several aspects of corporate ESG disclosure trends and some advice for companies getting started on their journey.

I invite you to have a watch or listen! Here are some of the highlights:

How to think about 2026 based on what’s happening now (@ 5:10)

In the wake of the regulatory pullback we have witnessed in both the United States and the European Union, what we haven’t seen are massive layoffs in sustainability reporting staff, mainly because the larger companies that have been producing sustainability reports (largely on a voluntary basis) are showing no signs of stopping. We also haven’t seen procurement teams reducing their ESG requirements, which means B2B companies have not seen a slacking of expectations; if anything they are increasing.

While the overarching regulatory push that we had been expecting in order to drive change at scale has gone missing, there is still a lot happening in ESG disclosure practices.

The role of regulations (@ 9:55)

Disclosure regulations serve to make information widely available, comparable (because standardized), reliable (because externally assured), and easily accessible (because digitized and XBRL tagged).

The push for disclosure regulations arose precisely to meet the demands of investors (and large companies to some extent) for such information, because they’re looking at hundreds if not thousands of companies in making their decisions.

The absence of such regulations may breathe some life back into sustainability questionnaires, because they allow for the collection of comparable information from a large number of companies. Interestingly, we’re also seeing standard setters like GRI and EFRAG build similar data collection platforms to facilitate standardized disclosures of smaller companies.

Do what, exactly? (@ 14:54)

We’ve been hyper focused on disclosures lately but they’re not an end in themselves, they’re a means to an end.

Exactly what are companies being asked to do: is it to disclose, or to manage, their material (read: relevant) issues? They may actually not need to disclose—especially if regulations are postponed—but they may want to manage their impacts, risks, and opportunities that are material to the conduct of their business. In any event, if they do want or need to disclose, it will be about what they manage.

Where to start (@ 18:44)

In my opinion, companies all too often skip some basic but foundational questions.

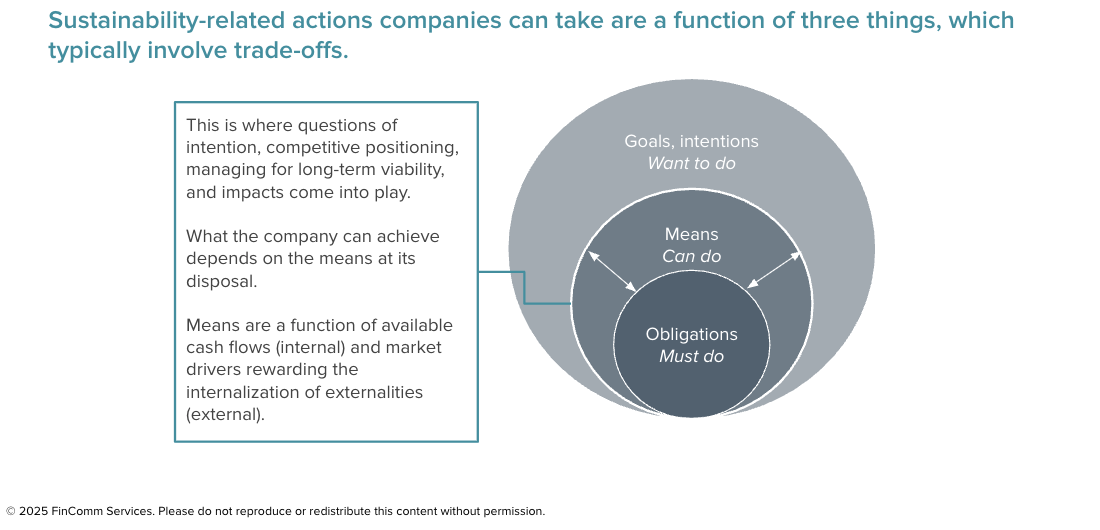

When it comes to sustainability, actions companies can take are a function of three things, which typically involve tradeoffs:

- Their intentions (what they want to do)

- Their means (what they can do)

- Their obligations (what they must do) – whether regulatory, contractual, or commercial

Every company is different and needs to make this assessment for itself.

Topics to address no matter how the future unfolds (@ 27:40)

You will often hear that materiality is the starting point of any sustainability-related strategy or process, and I completely agree. Reporting practitioners must understand the concept of materiality – of topics and of information – because they are being asked to manage and disclose [material] information on their [material] issues, and materiality is context-specific. This holds true regardless of the chosen lens of materiality (impact, financial, or both).

Some topics that may be considered universal (which would certainly be the case judging from an analysis of the first cohort of CSRD reports):

- Climate change - ubiquitous because it affects everyone in one way or another (and if it doesn’t affect you, your stakeholders will want to know that, too)

- Human capital and human rights - ubiquitous for any company that employs humans

- Ethical business conduct