Stats on use of IFRS sustainability frameworks

Oct 07, 2025

The IFRS Foundation has been keeping tabs for several years on the number of reporting companies that use the SASB Standards or the Integrated Reporting Framework—a relic of the Sustainability Accounting Standards Board days. More recently, it has begun doing the same for companies referencing the IFRS Sustainability Disclosure Standards (IFRS SDS, or ISSB Standards, or IFRS S1 and S2).

Note that this information is available to members of the IFRS Sustainability Alliance.

Key stats

In 2025 year to date, the IFRS Foundation has identified:

- 2,660 unique reporters using the SASB Standards (in 73 countries)

- 1,005 unique reporters using the Integrated Reporting Framework (in 64 countries)

- 2,074 unique reporters referencing the ISSB Standards

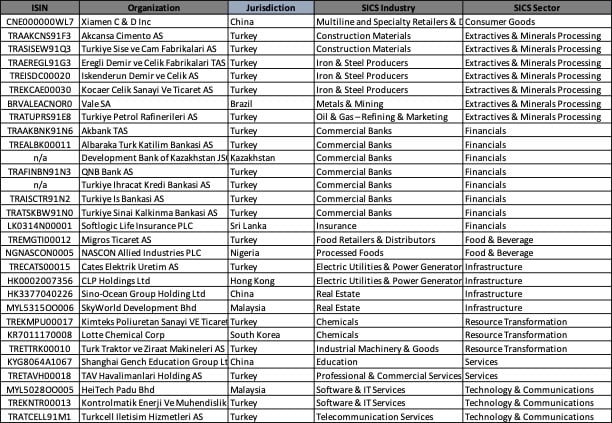

Of the companies referencing ISSB Standards, only 30 of these organizations “assert compliance” with the standards. You can see the names in the table below. Other reference types include “stated partial alignment” (477) and “planned alignment” (1,567).

Paradoxically, most companies asserting compliance are based in Asian jurisdictions, where uptake in ESG-related disclosures has been historically slower but catching up quickly in the last year.

Needless to say, it’s still early days when it comes to actual global implementation of the IFRS SDS Standards. And that's OK. We’re all collectively just figuring it out. I would expect these numbers to increase significantly once the regulations making standardized disclosures mandatory come into effect.

Examples are now real

Many practitioners have been eager to obtain real-life examples of ISSB compliant reports. I would suggest picking one or two names from the list below (ideally from companies in your sector, if that's available) and checking them out.

Photo credit: Excerpt from IFRS Foundation statistics table

List of companies producing a report compliant with ISSB Standards YTD 2025 (August)

Another example would be the European Bank for Reconstruction and Development (EBRD)'s recently published “ISSB Report” for its fiscal year ending 31 December 2024. It claims to be the first multilateral development bank to publish sustainability disclosures in accordance with the ISSB Standards. (EBRD is an international financial institution investing in private and public projects, offering financial products, and providing policy and advisory services to foster the transition towards open market-oriented economies and to promote private and entrepreneurial initiative. It is owned by 71 countries, including Canada (a founding member) and the European Union.)