How standards serve to consolidate [sustainability-related] data

Sep 24, 2025

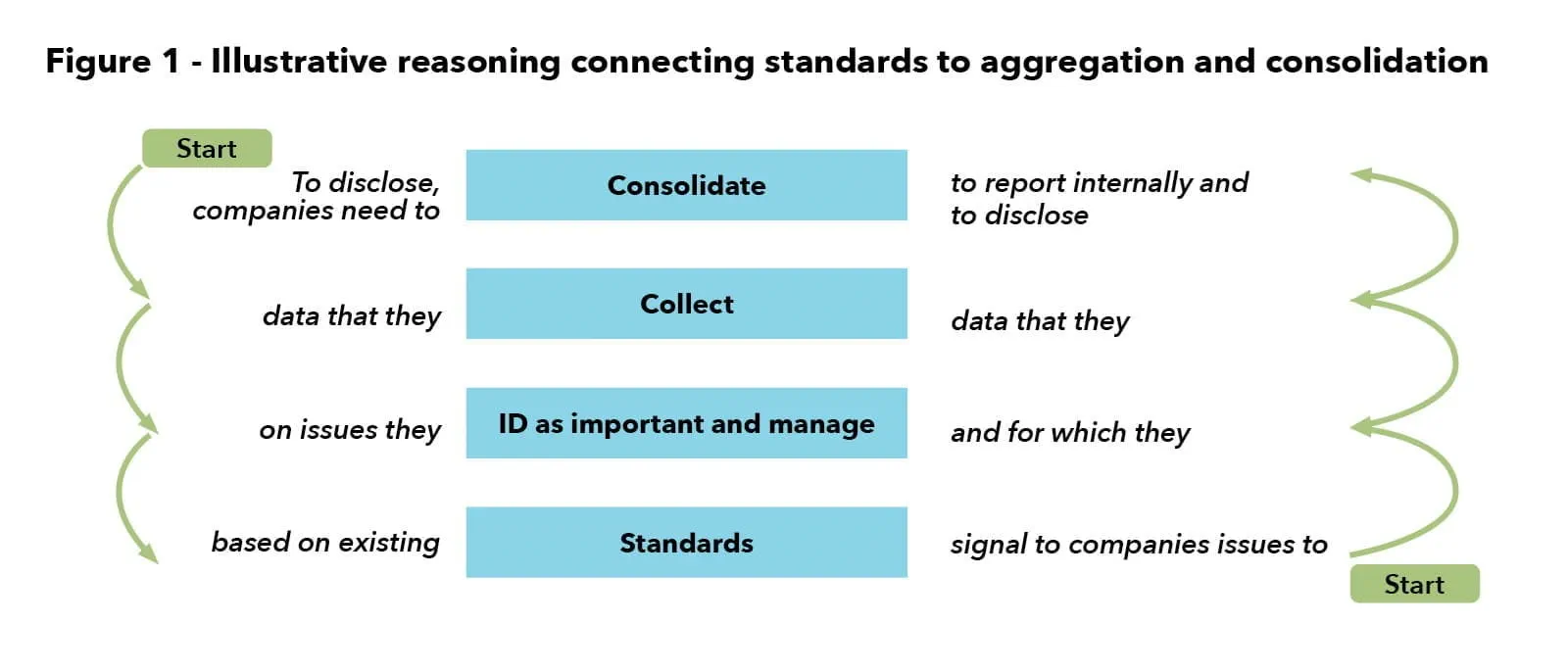

The standardization of sustainability-related information not only enables companies to collect context-specific datasets that can also be consolidated to report group-level performance, it provides a structured approach to help companies identify the impacts, risks, and opportunities that require recognition, management, and reporting, at both the local level and the group level.

This article is inspired by an article co-written with David Wray, MBA, ACA, CPA and published by the Institute of Chartered Accountants in England and Wales (ICAEW), as part of a series on Connecting Sustainability and Finance.

Companies need good information, or data, to manage their business effectively. For companies with more than one office, plant, or location, such as subsidiaries, the information is dispersed throughout the organization. To obtain a complete picture of performance, data must be collected and aggregated, or in accounting parlance, consolidated.

Finance and accounting professionals are used to dealing with dispersed financial information, but sustainability-related information poses particularly interesting challenges. Indeed, any sustainability reporting practitioner trying to roll up diversity data, health and safety injury rates, or GHG emissions – heck, even employee numbers! – will have experienced some level of pain in the process.

The context changes things

Sustainability-related issues are often context-specific, so it follows that local management is ideally positioned to identify and manage their context-specific issues in a decentralized manner. They develop datasets that are relevant to their needs, including any specific jurisdictional requirements.

The challenge arises when individual entity datasets need to be aggregated or consolidated at the group level, and there are often inconsistent data definitions, formats, or even data collection frequencies.

Without organization-wide data standardization, this invariably leads to misaligned datasets and structures between the group’s entities. One simple but classic example is the use of metric vs imperial measurement systems!

To be clear, the problem is not having a decentralized management system for managing issues.

The problem is a lack of dataset standardization that simultaneously addresses the measurement of performance on sustainability-related issues at the local level in a way that can also be consolidated to measure performance at the group level to provide useful information to primary users of general purpose financial reports.

Standards help solve this problem. But that’s not the only thing they do.

Supporting materiality assessments

We know from financial reporting experience that when configuring systems to collect data, measure performance, and inform management decisions, finance professionals lean into recognized standards for guidance, including regulatory or ‘best practice’ standards. In the absence of standards, or even clear best practices through benchmarks or peer comparisons, practitioners may come to question whether the issue at hand is important for them to manage, measure, and disclose at all.

It would be a mistake to assume outright that an issue is not material because no standard exists. Nevertheless, in practice a standard definitely serves as a signpost to indicate that a materiality assessment is required, and where something is deemed material, it follows that it should be managed, measured, and reported upon appropriately.

In this respect, reporting standards go beyond simply providing users with comparable information to, ultimately, providing a structured approach to help companies identify the impacts, risks, and opportunities that require recognition, management, and reporting, at both the local level and the group level.

Illustration provided in the ICAEW article

Food for thought. Check out the full ICAEW article!